views

United States Energy Drink Market Size and Share Analysis (2025-2033)

Market Overview

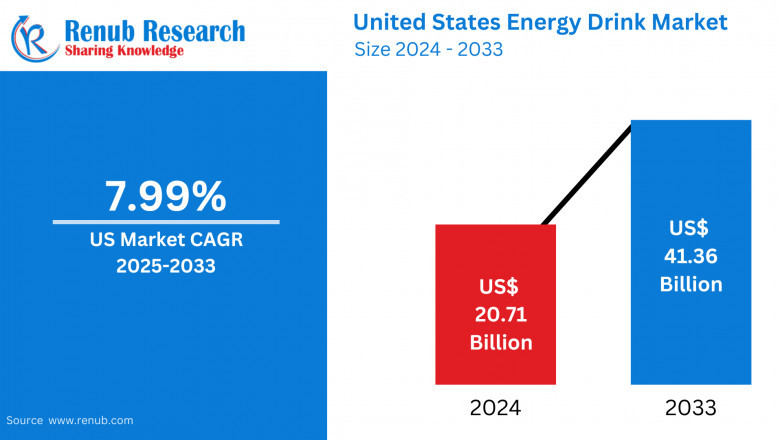

The United States energy drink market is projected to grow from USD 20.71 billion in 2024 to USD 41.36 billion by 2033, expanding at a CAGR of 7.99% during the forecast period. This rapid expansion is primarily fueled by the rising demand for energy-boosting beverages among athletes, professionals, and young adults. Market growth is also supported by innovations in flavor profiles, sugar-free variants, and functional ingredients such as vitamins, amino acids, and herbal extracts.

Press Release Highlights

- August 2024: 7-Eleven, Inc. introduced 7-Select Fusion Energy and 7-Select Rehydrate to cater to the on-the-go consumer segment.

- September 2024: GURU Organic Energy Corp launched its Zero Sugar line in the U.S. via Amazon and retail partners.

- October 2024: Nutrabolt, parent of C4, unveiled new energy products at the NACS Show featuring Kevin Hart.

- January 2024: Rockstar launched "Rockstar Focus," designed to enhance mental and physical performance.

Market Drivers

1. Rising Demand for Convenient Energy Solutions

Busy lifestyles are pushing consumers—especially young professionals, students, and athletes—toward convenient and portable energy-boosting options. The wide availability and variety of flavors in energy drinks make them a go-to solution for combating fatigue and improving alertness.

2. Health-Conscious Consumer Trends

The growing demand for healthier functional beverages is reshaping the energy drink landscape. Companies are increasingly developing sugar-free, low-calorie, vitamin-fortified drinks that appeal to fitness-focused consumers.

3. Product Innovation and Strategic Marketing

The U.S. market is witnessing continuous product innovation, with brands launching natural, organic, and performance-enhancing drinks. Influencer-led digital marketing campaigns and sports sponsorships have become key in driving brand engagement and expanding reach among Gen Z and millennial consumers.

Market Challenges

1. Health and Regulatory Concerns

High caffeine and sugar content in traditional energy drinks has raised concerns over health risks like insomnia, jitteriness, and cardiovascular issues. This has prompted regulatory scrutiny, leading to age restrictions and mandatory product labeling.

2. Market Saturation and Competitive Pressure

The U.S. energy drink market is highly saturated with numerous established and emerging players. The fierce competition leads to reduced profit margins due to price wars, promotions, and challenges in product differentiation.

Segmental Analysis

By Type:

- Alcoholic

- Non-Alcoholic: Fastest-growing segment driven by demand for herbal and taurine-based products.

By Product:

- Non-Organic

- Organic: Gaining popularity as consumers seek cleaner ingredient profiles and sustainable products.

- Natural

By Packaging:

- Plastic

- Glass

- Metal: Dominant format due to durability and portability preferred by younger consumers.

- Others

By End-User:

- Kids

- Teenagers: High growth driven by celebrity and influencer endorsements.

- Adults: Largest consumer base driven by busy lifestyles and fitness routines.

By Gender:

- Men

- Women: Rapidly increasing participation in energy drink consumption driven by tailored marketing and healthy formulations.

By Distribution Channel:

- Convenience Stores

- Foodservice

- Mass Merchandisers

- Supermarkets: Leading channel due to variety, trust, and product accessibility.

- Others

Emerging Trends

Organic Energy Drinks

The organic segment is expanding rapidly as health-conscious consumers seek beverages free from synthetic additives, pesticides, and artificial sweeteners. The appeal lies in the promise of natural energy boosts and ethical production standards.

Functional and Canned Drinks

Canned energy drinks dominate due to their functionality and convenience. Increasingly, brands are packaging performance-oriented drinks fortified with vitamins, electrolytes, and adaptogens in cans to meet consumer demand.

Competitive Landscape

Major Companies Covered:

- Red Bull

- Overview: Market leader with strong brand recall.

- Recent Development: Continued product expansion and sports sponsorships.

- Revenue Analysis: Consistent growth across U.S. retail channels.

- Monster Beverage Corporation

- Overview: Key innovator in product diversification.

- Recent Development: Collaborations and limited-edition flavors.

- Revenue Analysis: Steady gains from core and new offerings.

- PepsiCo (Rockstar)

- Overview: Strong multi-brand energy drink portfolio.

- Recent Development: Launched "Rockstar Focus" in Jan 2024.

- Revenue Analysis: Competitive performance in both traditional and functional drink categories.

- National Beverage Corp

- Overview: Focused on value-oriented and youth-targeted products.

- Recent Development: Introduction of hybrid hydration-energy drinks.

- Revenue Analysis: Positive growth in mass merchandiser segments.

- Suntory Holdings Limited

- Overview: Diversified portfolio with growing U.S. footprint.

- Recent Development: R&D into herbal energy formulations.

- Revenue Analysis: Moderate growth driven by natural ingredient positioning.

- The Coca-Cola Company

- Overview: Expanding energy drink line under brands like "Powerade" and "Coca-Cola Energy."

- Recent Development: Reformulated products with cleaner labels.

- Revenue Analysis: Increasing contribution from healthier variants.

- Campbell Soup Co.

- Overview: Leverages organic and wellness-oriented branding.

- Recent Development: Entry into the functional beverage segment.

- Revenue Analysis: Niche market appeal with steady sales.

- Amway Corporation

- Overview: Focuses on direct-to-consumer wellness drinks.

- Recent Development: Launch of new herbal and vitamin-rich energy beverages.

- Revenue Analysis: Driven by loyal distributor network.

Conclusion

The U.S. energy drink market is undergoing dynamic transformation marked by innovation, health consciousness, and evolving consumer demographics. Growth is projected to be robust through 2033, supported by favorable lifestyle trends and strategic product diversification by market players. However, companies will need to navigate health-related scrutiny and intense competition through transparent labeling, natural formulations, and differentiated branding to sustain long-term success.

Comments

0 comment