views

United States Wedding Services Market Size and Share Analysis - Growth Trends and Forecast Report 2025–2033

Press Release

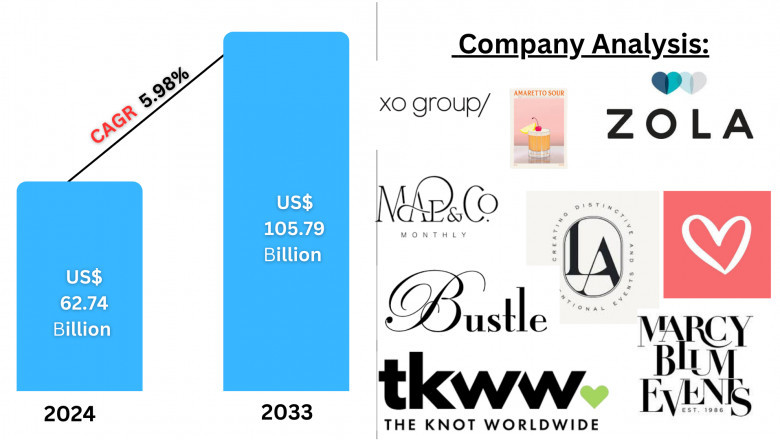

The United States wedding services market continues to flourish, driven by shifting consumer expectations, the rise of destination weddings, and digital transformation in wedding planning. According to the latest research report, the U.S. wedding services market was valued at USD 62.74 billion in 2024 and is projected to reach USD 105.79 billion by 2033, growing at a CAGR of 5.98% during the forecast period (2025–2033). This growth reflects increasing demand for personalized experiences, the proliferation of wedding tech platforms, and the expanding influence of social media in shaping wedding trends.

Market Overview

The wedding services industry in the United States encompasses a broad range of offerings including catering, decoration, planning, photography, entertainment, and more. As couples prioritize customization, convenience, and seamless execution, service providers are responding with innovative and all-inclusive packages that simplify event execution while elevating the experience.

Key Market Trends and Growth Drivers

1. Demand for Customized, Experiential Weddings

Couples today seek weddings that reflect their personalities and values, fueling demand for bespoke menus, unique venues, and thematic experiences. Social media platforms like Instagram and Pinterest continue to shape visual expectations, prompting vendors to offer highly curated, "Insta-worthy" experiences. Wedding planners are increasingly offering immersive event experiences and themed storytelling, which contributes to market segmentation and innovation.

Recent Development: In January 2023, David's Bridal launched Pearl by David’s, an all-in-one vendor and planning platform, demonstrating the industry's pivot toward personalization and digital integration.

2. Popularity of Destination Weddings

Scenic locations such as Hawaii, California, and Florida have emerged as top choices for domestic destination weddings, blending ceremony and honeymoon into a singular experience. Venues and resorts are creating tailored wedding packages that handle every logistical detail, making them attractive to both U.S. and international couples.

Insight: Roughly 15% of destination weddings in the U.S. are driven by foreign clientele, particularly from Canada, the UK, and Mexico.

3. Digital Transformation in Wedding Planning

Digital platforms like The Knot, Zola, and WeddingWire have transformed the way couples interact with vendors, plan budgets, and manage guest lists. These platforms offer AI-powered vendor suggestions, virtual venue tours, and planning dashboards that simplify complex decision-making.

Recent Launch: In July 2024, The Knot Worldwide released new features to improve lead generation, enhance vendor visibility, and optimize the vendor-couple matching process, reinforcing the role of tech in modern wedding planning.

Market Challenges

1. Rising Costs of Wedding Services

Despite economic recovery, the cost of hosting a wedding in the U.S. continues to rise, prompting many couples to scale back or opt for DIY approaches. From catering to décor and entertainment, rising inflation and labor shortages have driven up vendor fees.

2. Seasonality and Economic Sensitivity

The U.S. wedding market is highly seasonal, peaking in spring and autumn. This leads to fluctuating revenues and staffing challenges for vendors. External disruptions such as weather events or economic downturns also affect consumer spending patterns.

United States Wedding Services Market Segmentation

By Product

- Local Wedding: Preferred for its accessibility and cost-efficiency, especially in culturally rooted or family-focused ceremonies. Local vendors, banquet halls, and community venues dominate this space.

- Destination Wedding: Gaining momentum due to its immersive appeal. Resorts and scenic outdoor venues offer all-in-one solutions, attracting both domestic and international couples.

By Booking Mode

- Online: Rising adoption driven by millennial and Gen Z couples using apps and websites for vendor selection, guest management, and digital invites.

- Offline: Still essential for hands-on consultation and real-time event troubleshooting. Many couples prefer personal engagement when making high-investment decisions.

By Service Type

- Catering Services: Focus on diverse, culturally inclusive, and eco-conscious menu options. Organic and vegan trends are rapidly gaining traction.

- Decoration Services: Driven by demand for customized aesthetics including rustic, boho, minimalist, and luxury themes. Tech-enhanced décor such as LED mapping and interactive installations is on the rise.

- Entertainment & Music: Live bands, DJs, cultural performers, and immersive shows form a crucial part of the guest experience.

- Videography & Photography Services: High-resolution drones, cinematic storytelling, and same-day edits are in demand.

- Wedding Planning Services: Hybrid planning models combining digital tools and physical consultations are gaining ground.

- Other Services: Include invitation design, transportation, hair & makeup, and honeymoon planning.

Competitive Landscape: Key Players Analysis (2025)

|

Company Name |

Overview |

Key Person(s) |

Recent Developments |

Revenue Contribution |

|

XO Group Inc. |

Operator of The Knot platform |

Tim Chi |

Platform enhancements, AI tools |

High |

|

Zola, Inc. |

Registry and planning site |

Shan-Lyn Ma |

Launched planning suite in 2024 |

Moderate |

|

The Knot Worldwide |

Industry leader in wedding tech |

Tim Chi |

Vendor insights & lead quality tools |

Very High |

|

Bodas.net |

Spanish wedding planning platform |

Nina Pérez |

Expansion into U.S. market |

Moderate |

|

Luxe Atlanta Events |

High-end planning services |

Michelle Gainey |

Luxury micro-wedding expansion |

Moderate |

|

Bustle Events |

West Coast luxury planning |

Jacin Fitzgerald |

Coastal destination offerings |

Moderate |

|

Mae&Co Creative |

Boho and minimalist wedding firm |

Kelly Golia |

Editorial-style setups |

Niche |

|

Amaretto Sour |

Boutique wedding planning |

Lisa T. |

Personalized planning models |

Niche |

|

Marcy Blum Associates |

Luxury event planning |

Marcy Blum |

Celebrity & high-profile events |

High |

Conclusion

The U.S. wedding services market is undergoing a transformative era characterized by digitization, personalization, and experiential design. Vendors who innovate and adapt to new consumer behaviors—especially by integrating digital tools with traditional services—are poised for success. With rising expenditure on weddings and a growing desire for unique, memorable celebrations, the industry is expected to flourish through 2033.

Comments

0 comment